Firefighters have the most dangerous job in the UK

- March 10, 2023

- 9:00 am

Iain Hoey

Share this content

- Firefighting is the most dangerous job in the UK, with the highest injury rate

- However, on average, Brits overestimate firefighters’ salaries by £7,000 a year

- Construction work is the deadliest industry overall, although none of the individual jobs rank in the top 10

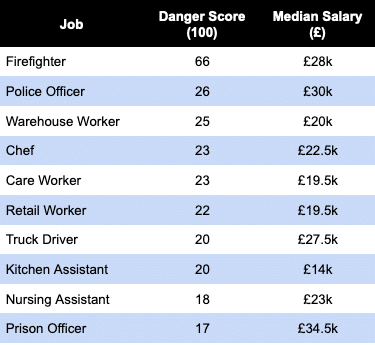

- Police officer and warehouse workers rank second and third on the dangerous jobs index

- Chefs and care workers are among the most hazardous jobs – filling out the top five

- Most dangerous jobs typically only pay between £20-£30,000k

- Over a third (35%) of those with a dangerous jobs don’t have life insurance

A new study by Forbes Advisor finds being a firefighter is the most dangerous job of all, with over 47,000 injuries over the past five years.

Using government data, experts at Forbes Advisor have compiled a list of the most dangerous jobs in the UK based on the number of deaths and injuries over five years in each profession.

Forbes Advisor also conducted a survey of 2,000 UK adults to ask Brits what they thought the most dangerous jobs were, as well as what they pay.

The median salary for a firefighter in the UK is £28,000, but, on average, most respondents thought a firefighter made £35,000 annually, overestimating their salary by £7,000.

Following firefighters, the study shows that the second and third dangerous jobs are police officer and storage worker, followed by chefs and care workers in fourth and fifth position.

Forbes Advisor’s study looked through data from the Health and Safety Executive and the Home Office to determine which job is the most dangerous, giving the highest weighting to deaths, followed by injuries and injury rate, between 2015 and 2020.

With regards to dangerous industries, construction heads the list, although specific professions within the sector do not feature in the top 10 dangerous jobs table, as each one separately scores less than jobs in other areas.

The three most dangerous jobs in the construction industry are tradespeople, builders, and civil engineers, totaling 181 deaths between 2015 and 2020.

While most Brits agree that people in dangerous professions should be paid more, most of the jobs that are considered dangerous do not pay above £30,000 a year, sometimes under £20,000, and lower than the national median wage of £33,000.

This is confirmed by Forbes Advisor’s survey, which asked respondents what their yearly salary was, and whether or not they considered their jobs to be dangerous.

The most common wage response (35%), for those who consider their jobs to be dangerous, was between £20,000 and £40,000 a year. Of those who made over £100,000 a year, 6% said they had a dangerous job, in contrast to 10% who said their line of work was not dangerous.

When asked what salary they would demand in order to accept a job where they have a one in four chance of getting seriously hurt or injured, the average Brit would not accept an offer under £94,000 a year, with nearly one in four (24%) saying they would not take such a risk in the first place.

For those with jobs where one might get seriously hurt or die while on the job, a life insurance policy is a good idea to make sure one’s family receives support after they die. However, more than a third (35%) of those who said their job was dangerous admitted not having life insurance.

Kevin Pratt, personal finance expert at Forbes Advisor, said: “Anyone with dependants should have life insurance, and it makes particular sense for those with high-risk occupations, whether that is a firefighter, someone on a building site, or a chef in a hectic kitchen.

“If you die without life insurance in place, your family will likely struggle with the burden of the rent or mortgage and all the other bills and expenses that families encounter. But the proceeds of a life insurance policy can make up for the loss of your income, providing a financial safety net at a time of deep distress.

“No-one likes to think of their own death, but those in high-risk occupations are reminded every day of the dangers they face. Arranging insurance cover is straightforward and relatively inexpensive – premiums reflect your age and occupation, starting at around £20 a month.

“Whatever your line of work, and even if you don’t have a traditional job beyond looking after the home and family, you should ask yourself a question: Am I guaranteed not to die before everyone who depends on me is financially self-sufficient? The answer, of course, is no. That is why life insurance is a good idea for everyone.”